Looks like since the end of February, after a brief deflationary downturn, inflation has chugging right along at the historical trend of 2.9 % on an annual basis.

Up to now, it appears as though the stimulus is working.

For those who swear it was a disaster, and can use evidence other than some version of an unemployment statistic, please leave a comment, because I am not a student of economics, and I enjoy learning from those who know more about it than I.

Chart: consumer price index all goods (including food and energy) 1999:2010

Chart: consumer price index all goods (including food and energy) 2004:2010

What was the goal of the stimulus package? to "turn the economy around"?

How does one measure an economic turnaround?

Its defined by changes in quarterly GDP growth.

What is GDP?

GDP

GDP is an estimate of the dollar value of all of the final goods and services produced by the economy. It is measured by all of the products consumed by the economy.

Sustained growth of profits by corporations and individuals will drive GDP growth.

Strong GDP growth in the long run will eventually lead to high employment rates, up to a theoretical limit known as "full-employment", assumed to be around 95% (this is debated) as corporations compete with one another in the labor market for a chance to take advantage of the future GDP growth.

As the employment approaches its theoretical limit, any additional GDP growth may result in the corporations relative demand for fixed supply of goods and services putting upward pressure on prices as the economy reaches full capacity (inflation). Persistently high inflation erodes the purchasing power of future profits and will put downward pressure on gross investments, and force a contraction in GDP growth.

When GDP starts to contract, this puts downward pressure on product prices as corporations are no longer interested in chasing profits through seeking increased future revenues, but rather by shedding operating costs and current liabilities. This race to the bottom is simultaneously associated with dropping prices (deflation) and dropping employment. This drop in prices only further depresses GDP, and in very bad recessions if the corporations do not quickly shift back to chasing profits and future revenues, it may begin to have downward pressure on nominal wages, and turn into a depression.

So expectations about future price growth (inflation) can have a big effect on an economy's gross consumption and investment activity. Deflation fears will force a contraction in consumption as the economy is more concerned with reducing costs than with chasing revenues, and

Inflation fears can force a contraction in gross investment due to the diminished real returns of future profits.

How does an economy control inflation expectations?

Very carefully. By manipulating the supply of money, the central banks can influence expectations about future inflation, although it is more of an art than a science. Some may argue that this tinkering should be kept at an absolute minimum, preferably managed by a computer, as it can have devastating effects for entire economies if they make a mistake by overshooting/undershooting.

How much inflation/deflation is too much?

Economists seem to think that 2.5 - 3.5 % annual inflation is a good rule of thumb, that it is better to air on the side of inflation, rather than deflation, and the reason apparently has to do with the way the labor market works, that employees are much more willing to take no raise at 2% inflation than a -2% drop in wages at 0% inflation. An employer faced with the situation of having to reduce payroll costs can do so only by either inflating out, or by reducing head-count, and almost never by cutting hourly wage rates.

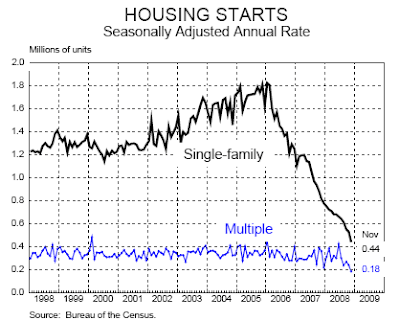

So, when the housing market started to collapse, the economy shocked itself into a deflationary contraction. At this point, the FEDs had two choices, do nothing, or attempt to ease fears of deflation by increasing the money supply and hopefully get back on track at 3 % inflation. Since doing nothing will almost certainly attract criticism of incompetency, they chose to increase the money supply in the form of bailouts and stimulus packages.

The stimulus package

Earlier in the heat of the financial crisis, credit was disappearing and consumer spending was shrinking rapidly. The economy started to contract into a deflationary period, with food, energy and cyclical consumer product prices dropping steeply from their peak in 3Q 08. The fear was that if the trends continued, and the stimulus package not strong enough to thwart the trend, the short term contraction in prices would continue, and lead to long term downward pressure on the labor market and nominal wages and a halting of economic activity in general.

The purpose of the stimulus package was to prevent the economy from spiraling down into a deflationary economic free fall.

The risk associated with the stimulus package and FED bailout of the financial sector was long term inflation risk, since injecting massive amounts of cash into the economy at once opens the economy up to the problem of to many dollars chasing too few goods, otherwise known as inflation. The FEDs knew this, and made a conscious decision to sacrifice fears of long term inflation in order to fight short term deflation risk. The idea is that if they inject just the right amount of cash, it will be enough to turn around the trend of plummeting deflation, but no so much as to result in an ignition of runaway inflation.

The results (6 months in . . .)

Starting in February, the deflationary contraction turned around into an inflationary trend, but rather than an explosive runaway Banana Republic style disaster, it has been a mild inflationary trend more or less comparable to the US average for the past 30 years 2.9%

If the trends continue like this, I would say the stimulus/bailouts was a bullseye.

What about the employment rate?

Unfortunately, employment trends lag all of the other economic indicators. corporations look for sustained GDP growth before they begin gradually ramping up their payroll numbers. Luckily, if you have a 4-year degree, you probably won't have to worry about the employment rate. If you don't have 4-year degree, I'm really suprised that you are still reading this blog, and would recommend that you go get a 4-year degree.

Questions to ponder

1. Could the graceful turnaround in 2Q 09 been explained by some other outside factor? ( Obama's magical powers, Aliens, China, God, the awesomeness of the American people, Google) ?

2. will the current trend continue?

By the way, if you suddenly find yourself frequently debating whether some very large global event was caused by God, China, Obama, Google, or the FEDs, there is a very rational explanation for that apparent correlation.