Sunday, April 5, 2009

Tuesday, March 3, 2009

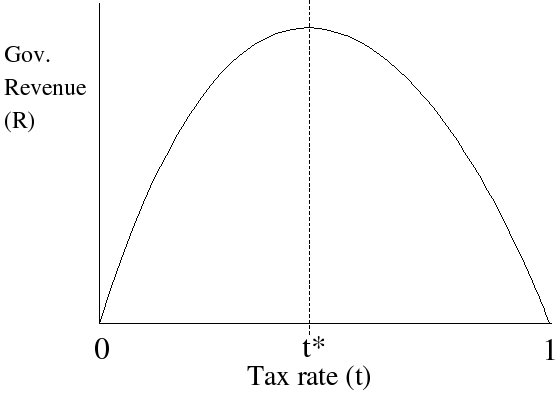

The Laffer Peak - Can the US take any more taxes?

At the extremes were 0% and 100% tax rates and 0 marginal tax revenue, and "somewhere inbetween" lay a maximum, or optimal marginal tax rate that would provide just low enough to motivate the population to remain productive, but just high enough so that the government would reap some of the benefit as well. Some have actually tried to calculate just where this optimal value likes using time series regression analysis, such as this paper by Yu Hsing at Southeastern Louisiana University, USA claiming that the optimal marginal tax rate for income tax is between 32.67% and 35.21%

Today, economists and politicians alike are still struggling with just where that magical "optimal tax rate" lies.

Excel graphs for those who like to squint. The top graph is the overall tax revenues as % of GDP as a 2 year moving average. The bottom graph is real GDP growth rate 5 year moving average.

If anyone knows how to embed excel charts into blogs, please share.

I took data from the US Office of Management and Budget to determine the overall effective tax revenue as % of GDP, and real GDP growth. The real GDP growth was calculated by dividing by the Consumer Price Index for that year. The GDP values are 5 year moving averages.

From Kennedy to the present, each administration has had it's try at manipulating the tax codes to stimulate the economy. From Johnson to Bush senior, a clear trend appeared to take shape - whether or not a Democrat or Republican was in office, whoever decided to raise taxes would see a subsequent drop in real GDP, and consequently whoever lowered taxes saw a rise in real GDP.

Until Clinton . . . from Clinton on, the trend appeared to have reversed?

Clinton continuously raised the overall tax revenues as a % of GDP in an effort to run a surplus and pay down the national debt. The result - a booming economy with continued rise in real GDP.

And then along came Bush, with significant tax cuts early on, but no real gain in real GDP, and when the tax revenue rose as % of GDP no Clintonesque miracle boom, but rather a bust, as the laffe curve would have predicted.

So even though it looks good on the back of a napkin, this "optimal" value appears to be very elusive, and can make any president or congress look like a fool if they play this game the wrong way. Right now Obma is banking on a GDP recovery, and critics are not so optimistic that now is the best time to be paying down the national debt by increasing overall tax receipts just like the Clinton administration did.

How low too low and how high is too high?

Here's a pick of countries with the lowest, and the highest capital gains tax rates from the Howie Institute. Looks like Congo, China, Germany and the US are at the top at ~ 38%

and Singapore, Ghana and Mexico at the bottom, ~ 10% even as low as 6% (Hong Kong).

Apparently there is more to public policy and economic development than the effective or marginal tax rate, and simply adjusting your tax rates to meet your spending and defecit wishlist targets doesn't always result in immediate economic growth.

In a recent CNN article, Jeanne Sahadi takes a critical look at the underlying assumptions behind the recent budget proposal by the administration.

Reality check on Obama's deficit plan

By Jeanne Sahadi, CNNMoney.com senior writerThe administration laid out several key approaches to whittling down U.S. debt. Whether they pan out as the president hopes is a question mark.

...

Raising taxes on high-income filers

The assumptions: Reduce the deficit by $637 billion over 10 years by letting the Bush tax cuts expire in 2011 for singles making more than $200,000 and couples making more than $250,000.

Reality check: Letting the tax cuts expire has a good chance of happening. But the savings that achieves could be undercut if two other revenue raising efforts don't pan out.

...

Obama hopes to raise $318 billion over 10 years with this provision and use it to help pay for his new health reform fund.

Separately, he wants to make permanent his signature credit for low- and middle-income families and fund it by requiring companies to pay for the amount of carbon emissions they produce. He estimates a cap and trade program, which is the subject of much debate, would raise $646 billion.

If either or both of these revenue raisers don't pan out, the administration will have to propose other ways to help pay for his new initiatives or risk further increasing the deficit.

"The key to the budget is whether they stick to that pledge [to pay for their new proposals] because they have the potential to add enormously to the deficit if they're not paid for," said Bob Bixby, director of the Concord Coalition, a deficit watchdog group.

Wednesday, February 25, 2009

Social Security Reform - Now officially on the Obama Agenda

(Halelujah corus playing ... )

I'm speechless. . .

Reform of the entitlement programs, Social Security, Medicare, and Medicaid

-the "elephants in the room" that are the biggest threat to the 'AAA' rating of US Treasuries, and the future of the US economy-

is now officially on the agenda.

To preserve our long-term fiscal health, we must also address the growing costs

in Medicare and Social Security. Comprehensive health care reform is the best

way to strengthen Medicare for years to come. And we must also begin a

conversation on how to do the same for Social Security, while creating tax-free universal savings accounts for all Americans.

- Barack Obama, February 24 2009 State of the Union Address

For years no politician would dare touch the issues because the backlash from the interest groups would be political suicide.

But this Administration is different.

They are focused on fearless leadership and instilling a vision of hope for healthy change in the areas the America is the weakest. They are not afraid of facing some tough political opposition, or having to ask Americans to sacrifice for the good of future generations. This bold leadership quality is unlike any seen since the last Great Depression, and although it may hurt, it is the only way the US can emerge from this crisis stronger and better prepared for the 21st century challenges.

This is encouraging news, and should resonate throughout the media and public to ensure that the Administration follows through on pushing their agenda. This is the time for those that will most be affected by Social Security reform to speak up, and voice their concerns and hopes about entitlement reform. This issue cannot slide to a second or third priority agenda. If it is not resolved now, there may not be another chance.

Wednesday, February 11, 2009

$819 billion stimulus bill - break down

I scrolled through the bill and looked for allocations, then added them all up.

I came up to a total of $367 billion of committed funds. I heard that the tax provisions alone were around $275 billion, which adds up to $ 642 billion. The remaining ~ $177 billion must come from the other provisions of the bill - Unemployment Assistance, Health Insurance and Health Information Technology, Energy, Broadband Communications, and Education, which are indicated in blue italics.

Feel free to add comments and corrections as necessary.

Oversight and Auditing $0.2 billion

Justice $4.0 billion

State and Local Law Enforcement

Community Oriented Policing

Homeland Security $1.1 billion

Customs and Border - Salaries

Customs and Border - Construction

TSA - Aviation Security

Coast Guard - Bridge Alteration

FEMA - Emergency Shelters

Social Security Immigration Reform

Defense $9.35 billion

Facilities

Operations - Army

Operations - Navy

Operations - Marine Corps

Operations - Air Force

Defense - Health

Operations - Army Reserves

Operations - Navy Reserves

Operations - Marine Corps Reserves

Operations - Air Force Reserves

Operations - Army National Guard

Operations - Air National Guard

Research - Army

Research - Navy

Research - Air Force

Research - Defense Wide

Military Construction and Veterans Affairs $7.0 billion

Military Construction - Army

Military Construction - Navy and Marine Corps

Military Construction - Air Force

Military Construction - Defense Wide

Military Construction - Army National Guard

Military Construction - Air National Guard

Military Construction - Army Reserves

Military Construction - Navy Reserves

Military Construction - Air Force Reserves

Defense Base Closure Account

Veterans Affairs - Medical Facilities

National Cemetary

State Department $ 0.5 billion

Foreign Affairs - Capital Investments

US-Mexico Border Construction

Government Operations $8.3 billion

Federal Buildings

Energy Efficient Federal Vehicles

Interior $15 billion

Land Management - Construction

Fish and Wildlife - Construction

National Parks - Construction

National Mall

Centennial Challenge

US Geological Survey - Surveys and Research

Indian Affairs - Construction

EPA - Hazardous Substances

EPA - Leaking Underground Tanks

EPA - Clean Water

EPA - Drinking Water

EPA - Energy Policy

EPA - Environmental Response and Liability

Forest Services - Capital Improvements

Wildlife management - hazard reduction and rehabilitation

Wildlife management - State fire management

Health and HS - Indian Health Facilities

Smithsonian - Facilities

Arts and Humanities - Grants

Energy and Water $45.7 billion

Corps of Engineers - Construction

Corps of Engineers - Mississippi River

Corps of Engineers - Operations

Corps of Engineers - Regulatory

Interior - Water Resources

Dept of Energy - Energy Efficiency and Renewable Energy

Electricity Delivery and Reliability

Battery Loans

Institutional Loans

Innovative Technology Loans

Carbon Sequestration

General Energy Science

Defense Environmental Cleanup

Hoover Power Plant - Loan

corrections to the Energy Independence and Security Act of 2007

Renewable energy and electric power transmission loan guarantee

rapid deployment of renewable energy and electric power transmission

weatherization assistance program

renewable electricity transmission study

state energy grants

Agriculture $34.5 billion

Agriculture Buildings and Facilities and Rental Payments

Buildings and Facilities

Salaries and Expenses

Watershed and Flood Prevention

Watershed Rehabilitation

Rural Community Advancement Loans

Rural Loan Administration

Rural Housing Insurance

Rural Housing Loan Admin

Rural Utilities

Child Nutrition

Food Assistance

Administration - Agriculture

Commerce $1.3 billion

Economic Development Assistance

Census

Financial Services $3.4 billion

Small Business Loan administration

Small Business Loan Allocation

Telecommunications $3.8 billion

Telecommunications Salaries

Wireless and Broadband Grant

Digital to Analog Boxes

Inventory of broadband service capacity

wireless and broadband deployment grants

national broadband plan

Transportation $43.1 billion

Federal Aviation Administration - Airport Grants

Federal Highway Administration - Highway Investments

Federal Railroad Administration - Intercity Passenger Rail Investment

National Railroad Passenger Corporation - Capital and Debt Service Grant

Federal Transit Administration - Transit Investment

Federal Transit Administration - Fixed Guideway Investment

Federal Transit Administration - Discretionary

Housing and Urban Development $16.3 billion

Indian Housing

Elderly and Disabled - Energy Retrofit

Native American Housing Block Grant

Community Development Fund

Neighborhood Stabilization - foreclosure avoidance

HOME Investment partnership program

Self Help and Assisted Home-ownership

Homeless Assistance Grant

Lead Hazard Reduction

Education $143.5 billion

Elementary and Secondary - Education for the Disadvantaged

Elementary and Secondary - Impact Aid

Elementary and Secondary - School Improvement

Elementary and Secondary - Innovation and Improvement

Elementary and Secondary - Special Education for Children with Disabilities

Higher Education - Student Financial Assistance

Higher Education - Student Aid Administration

Higher Education - General

Institute of Education Sciences

Elementary and Secondary - School Modernization, Renovation, and Repair

Higher Education - Modernization, Renovation, and Repair

State Fiscal Stabilization Fund

Amendment to Pell Grants

Increasing Student Loan Limit and Interest Rate Calculation

21st Century Green High Performing Public School Facilities

Scientific Research $4.9 billion

Technology Research

Industrial Technology Services

Research Facilities Construction

Ocean and Atmosphere Research

NASA - Science

NASA - Aeronautics

NASA - Disaster Relief

NSF - Research

NSF - Education

NSF - Facilities and Construction

Satellite Construction

Health $12.3 billion

Health Centers Grants

Health Centers - Repairs

Health Centers - Moving Expenses

Health Care Personnel and Training

Disease Control

National Institute of Health - Research

National Institute of Health - Discresionary

National Institute of Health - Facilities

Agency for Health Care Research - Discretionary

Health Information Technology

Public Health and Social Services Emergency Fund

Disease Control - Prevention

Discretionary Prevention

Assistance and extension of COBRA benefits

COBRA premium assistance

Penalty for failure to notify health plan of cessation of eligibility

Optional medicaid coverage

Health Information Technology and Quality provision

Labor and Human Services $12.5 billion

Employee Training

Community Service for Older Adults

State Unemployment Insurance

Department of Labor - Salaries

Office for Job Corps

Low Income Home Energy Assistance

Child Care and Development Grants

Children and Family Services

Community Service - Operations

National Service Trust

Social Security Administration - Computer Center

Social Security Administration - processing disability and retirement workloads

Aging Services

Extension of Emergency Unemployment Compensation Program

Increase in Unemployment Compensation

Unemployment Compensation Modernization

Emergency fund for TANF Program

One Time Emergency Payment to SSI Recipients

Temporary Resumption of Prior Child Support Law

Additional Medicaid provisions

Tax Incentives $ 275 billion (estimated)

Increased earned income tax credit

Increased child tax credit

American opportunity tax credit

waiver of repayment of first time buyer tax credit

low income housing credit

temporary investment incentives

temporary increase in limitations on expensing depreciable business assets

5 year carryback of operating losses

Exceptions for TARP recipients

incentives to hire veterans and disconnected youth

limitations on certain built-in losses following change of ownership

de minimus safe harbor exception for tax exempt interest expense of financial institutions

modification of smaller issuer exception to tax exempt interest expense allocation rules for financial institutions

temporary modification of alternative minimum tax limitations on tax-exempt bonds

school construction tax credit

qualified zone academy bonds

government bonds

recovery zone bonds

tribal economic bonds

repeal withholding tax on government contractors

electricity produced from renewable resources

investment credit in lieu of production credit

repeal limitations on credit for renewable property

coordinate with renewable energy grants

increased limitations on issuance of new clean renewable energy bonds

increased limitations and expansion of qualified energy conservation bonds

extension and modification of credits for non-business energy property

modification of credit for residential energy efficient property

temporary increase in credit for alternative fuel vehicle refueling property

increased research for energy research

application of certain labor standards to projects financed with tax-favored bonds

grants to states for low-income housing projects in lieu of low-income housing credit allocations

grants for specified energy property in lieu of tax credits

study of economic employment and related effects of the act

Tuesday, January 27, 2009

Peter Schiff - US Economy prophet - predicts the worst is yet to come

The scary part . . . his prediction for 2009 and beyond.

Foreign governments stop buying US Treasuries to subsidize the flailing US economy

This lack of confidence will tank the $US

Commodities (oil,gold) will rise creating massive inflation

Interest rates will rise and the economy will contract into a prolonged multi-year depression .

Peter criticizes the US government bailout on loaned money from China, Japan, and Saudi Arabia, that it's only delaying the inevitable , and that US citizens are consuming beyond their means, too leveraged, with dangerously low savings rates.

Peter's advice - Buy Swiss franc and Singapore Dollars , stick your head between your knees, and . . . you know the rest.

Information taken from February 2009 Fortune Magazine Article "He Saw it Coming"

Thursday, January 22, 2009

Ted Turner - A true global citizen

While reading about the newly appointed US State Department Special Envoy to Afghanistan and Pakistan, Richard Holbrooke, on Wikipedia, I came across an amazing piece of news --

Photo courtesy of http://periginatioanimae.wordpress.com/2008/06/22/the-news-is-very-biased/

In 2001 Ted Turner US media "mogul" and leader of many well known organizations such as CNN, Atlanta Braves, and the UN Foundation, donated $35 million of his own money to help the US pay the dues it owed the UN. This was the final missing link that enabled the US and the UN to resolve some of the conflict over the overdue us membership fees. The announcement of the final terms of the agreement were met with a standing ovation by the US Senate Foreign Relations Committee.

I was astounded by this gesture of humanitarianism and personal commitment to global agendas. Some may say that for him, $35 million is a "drop-in-the-bucket", but a quick look at his track record indicates this is not the first time he has been willing to cough up money for the global community. Take his $1 billion endownment for the UN Foundation, for example. The sacrifice Ted has committed towards advancing global causes is something everyone can learn from, and I believe following Teds example would be a noble goal for any global citizen.

Last Updated: 2:12PM BST 19 Jun 2001

Wednesday, January 21, 2009

Trying to sound the alarm - The "other" financial crisis

Medicare, Medicade and Social Security

The challenge is a challege of conflict between generations - a case in which the current working generation is paying the costs for the previous generation. The size of the problem is mind boggling, a debt problem unilke any the US has faced in its entire history. No politician or government authority has been brave enough to propose any real solution because the public has not been willing to make any sacrifices for another age group.

Until now

One brave Economist - Isabel Sawhill - speaks up on behalf of the senior generation to say that seniors will be willing to do their part in solving the crisis.

http://a.abcnews.com/Healt

From Money Magazine - November 2008 article by George Mannes "Why We Have to Cut Benefits for Seniors"

Whether or not Congress or the Federal Reseve manages to solve the financial crisis, there will be an equally scary situation that has not yet made newspaper headlines:

The big three of entitlement programs - Medicare, Social Security, and Medicade - will wreak havoc on the country's finances (and yours) unless we scale them back, says Isabel Sawhill, an economist at the Brookings Institute and member of a bipartisain think tank trying to sound the alarm.

Q: You talk about fixing the unwritten agreement between younger and older generations - the "intergenerational contract." What's broken ?

A: The existing contract assumes that the working age population is going to be able to support the older population - the retired population - out into the future and should do so. And that's not a sustainable assumption.

Q: And why not ?

A: 42 % of federal spending now goes to three programs, with the majority share to the elderly.

Two or three decades from now, those three programs will be as large as the federal government is today. Lets say someone is now paying 25% of their income in taxes. To maintain the commitments we've made to the elderly, they would have to pay 50%.

Q: What's the solution ?

A: We need those who can afford it to contribute more to their own retirement costs.

Take Social Security:

Right now the benefit formula provides a pretty good retirement income to those who make more than $100,000 a year. I don't think that the working age population should contribute to fund benefits for seniors who are so well off.

Q: And you want to spend this money instead on the younger generation ?

A: Yes

We would reap enormous enconomic benefits from spending more on early childhood education. It's like any investment that has a rate of return. If you do it when people are young, its going to help make them more productive and able to earn a reasonable living.

Q: Wouldn't the AARP crowd scream bloody murder about benefits reductions?

A: I don't think all older Americans are opposed to investing in their children and grandchildren.

Q: So how do you sell this idea of spending less on the elderly and more on the young?

A: We have to change the debate, which has been focused on the idea that there's going to be a generational warfare. I'm trying to get away from that concept by talking about the fact that

Every individual, every generation, should expect more from their government when they're young and less from the government when they're old.

That's not warfare.

That's common sense.

Collections and Credit Risk - signs of trouble in July 2008

01 July 2008

Collections and Credit Risk

(c) 2008 Collections and Credit Risk and SourceMedia, Inc.

All rights reserved.

As the year hits its midpoint, collection agency executives are warily looking ahead. They see a growing number of bad debt placements, but with a corresponding fall in liquidation rates. The failing economy and a housing mess, along with high gas and food prices, are putting a definite crimp in debtors' ability to repay their bills.

Amid the flood of bad debt placements, agencies are staffing up and working to leverage new technology to improve efficiencies. At the same time, lenders and financial institutions are lowering contingency rates and putting the squeeze on margins.

Unfortunately, most industry observers think it will be another year before liquidation rates really improve. So, for now, agencies are tweaking their tactics - negotiating repayment schedules, coaxing rather than pressuring, and so on.

"It's the same story across the board," says Patrick Carroll, president and CEO at Nationwide Credit, based in Kennesaw, Ga. "The economy has changed and liquidation rates are down everywhere. It's nowhere near as robust as it was."

Of course, the credit crunch that first hit last August started the spiral. Nine months later, with the economy weakened, over-leveraged consumers - burdened by too much credit card and mortgage debt - cannot repay their creditors. Consider:

* Credit card charge-offs continue to rise, according to a May report by Standard & Poor's. The overall charge-off rate of 5.7% in March 2008 was 120 basis points higher then the overall 2007 average of 4.5%.

* Delinquency rates are trending higher too, the report continues. March's 30-plus-day delinquency rate of 4.5% was 60 basis points higher than the overall 2007 average of 3.9%.

* Consumer bankruptcy filings increased about 48% nationwide in April from the same period a year ago, according to the American Bankruptcy Institute. The group expects consumer bankruptcies to top 1 million new cases this year.

* Foreclosures in the first quarter of 2008 increased 23% from the previous quarter, and 112% from the first quarter of 2007, according to RealtyTrac. It says one in every 194 U.S. households received a foreclosure notice during the first quarter.

* The unemployment rate, though still historically low, hit 5.1% in March, the highest mark since September 2005. In late May, the Federal Reserve raised its unemployment forecast to between 5.5% and 5.7%, up from an earlier estimate of 5.2% to 5.5%.

The failing economy has boosted debt placements at agencies by 10% to 30% over last year, says Michael Flock, managing director at Flock Advisors, a consulting firm in Atlanta. He says liquidation rates are down 5% to 10%. At Nationwide Credit, debt placements were up 23% in the first quarter of 2008, compared to the last quarter of 2007, says Carroll. At publicly traded NCO Group, a report filed May 5 with the SEC noted a "weaker collection environment during 2008." And, in a statement of its first-quarter results, NCO said the environment for third-party collections was weaker than expected.

Agency executives agree that placements are up and liquidation rates are down. Placements are up about 20%, says Arnie Harris, president and CEO at collection agency and law firm Harris & Harris, a 300-plus seat Chicago-based firm with call centers in Chicago and Milwaukee. A lender client provides Harris with scorecards that compare the performance of several agencies, including his own. He notes that of the three agencies on the scorecard, recoveries are down by an average of 20% compared to this time last year. "Two things are hitting consumers hard," notes Harris. "High gas prices and food prices. They can't afford to pay (their bills)."

Another big factor limiting repayment is the mortgage meltdown, agency executives say. Until last year, consumers could tap the equity in their homes to get loans to pay off debts, especially credit card bills. "That tool is gone," says Carroll at Nationwide Credit.

At Niagra Credit Solutions, based in Williamsville, N.Y., liquidation rates are off only slightly, says Danny Czyrny, executive vice president. The company collects tertiary debt. "Our debtors had problems two years ago," says Czyrny. But he believes liquidation rates are probably down 10% to 15% at agencies that handle fresh charge-offs.

Recoveries are not down across the board, however, agency executives say. "We are not seeing reduction in collectability," says Chris Wunder, president at Baltimore-based ROI Companies, which handles only health care claims. He attributes steady recovery rates in the health care segment to a relatively steady unemployment rate. Low-balance utilities and telecom debt were mentioned by agency executives as particularly difficult to collect.

The legal collections environment also is getting tougher, says Alan Weinberg, managing partner at Weltman, Weinberg & Reis, based in Cleveland. Court cases involving past due debts are being continued, or delayed, more frequently. Bankruptcy judges are more often requesting backup paperwork, such as the original loan applications. "Judges are banding together to help debtors," says Weinberg.

Some attorneys are rejecting work outright from some debt buyers thanks to a lack of documentation and low collectability rates, sources say.

"The cost of collections is high, so "[collectors] can't afford to throw resources on everything that comes in the door," says Robert G. Markoff, partner at Chicago-based Baker, Miller, Markoff & Krasny, and current president at the National Association of Retail Collection Attorneys.

An increase in placements has led agencies to staff up in an effort to handle all the business while refining collection techniques. "We have had to add more people because of the volume of business," says Carroll at Nationwide Credit. The company has about 1,300 employees and staffing has increased by about 35%, split about evenly between offices in the United States and the company's facilities in India.

Experienced collectors are somewhat scarce. "If I could find 40 people who can deal with insurance companies and patients, I can put them to work," says ROI's Wunder, 2008 president of trade group ACA International.

But a softening labor market could help fill demand for collection workers. At Baker, Miller, Markoff & Krasny, new staffers are being drawn from the mortgage industry, which has suffered big layoffs. "We find we can get a better quality staff member who knows something about collections and finance at a lower price," says Markoff.

New York City-based iQor has a new facility in the Philippines that should soon be fully staffed with 2,000 collectors. The company also is adding employees in the United States, says iQor spokesperson Chris Dorval, though he does not attribute the hike to rising placements but rather to the continued growth of the company.

At the same time, Dorval notes that big balance accounts are being kept in the United States because collectors here relate well to American consumers.

While expenses are increasing, lenders and debt purchasers are squeezing contingency rates, according to agency owners. Consolidation in the telecom and banking industries has provided companies in those sectors with some leverage in negotiating favorable collection contracts.

"Fewer customers with more volume means they dictate the prices," says Flock at Flock Advisors. Several other sources say contingency rates on fresh charge-offs are at about 20% to 25%.

Consumer repayment behavior is changing - a fact that will impact how collectors fare in the months ahead. In the past, consumers would pay their mortgages first, then secured loans and finally unsecured loans. Credit card bills were the last loans repaid in the traditional payment hierarchy, says Edmund Tribue, senior vice president and global practice leader at MasterCard Advisors in Purchase, N.Y. "We see a different behavior now."

Among certain populations, credit cards are being used to buy groceries and to pay utility bills. That means timely credit card repayments are more important than being current on a mortgage. Consumers have learned that foreclosure proceedings do not begin until after three payments are missed. Even after a foreclosure, the resident has six months to vacate the property.

"This is why we see a lag in rising delinquency rates considering that credit cards have record growth," says Tribue.

As a result, collection agencies are changing their strategies, determined to collect what they can. Shrewd collectors are pushing to have payment relationships with debtors to resolve accounts. "The probability of collecting the balance in full is less," says Carroll. "Smart collectors will get a down payment and enter into a payment schedule."

Looking ahead, it is hard to predict when the economy might improve. The persistent rise of gas prices does not bode well for a short downturn, economists say.

Many industry observers think more consolidation will follow as smaller agencies feel profit pressures. Agencies that service a niche might fare well, though companies that rely on contingency work from banks could see their margins squeezed even further.

In previous downturns, lenders typically tighten their credit policies which eventually results in fewer bad debts and fewer placements. Then as the economy recovers, liquidation rates gradually improve. Most industry observers think that process might take anywhere from six months to 18 months. Carroll at Nationwide Credit says today's placements will have a longer life cycle than at other times. He adds: "We're just not sure how long it will take this bubble to get through the system."